As a small business owner, you know how important it is to stay on top of your finances. Invoicing software has become an essential tool for businesses of all sizes, offering numerous benefits that streamline financial operations and improve efficiency. In this article, we’ll explore why invoicing software matters, how to choose the best option for your business, and the top invoice apps for small businesses in 2025.

Why Invoicing Software Matters

Invoicing software has become a game-changer for small businesses. Here’s why it matters:

- Improves Cash Flow Management: By automating invoice creation and delivery, invoicing software helps you get paid faster and improve your cash flow.

- Reduces Errors: With invoicing software, you can ensure accuracy in billing and reduce errors that can cost you time and money.

- Saves Time: Invoicing software automates repetitive tasks like data entry and calculations, saving you countless hours of manual work.

- Enhances Professionalism: With customizable, branded invoice templates, invoicing software helps you create a professional image for your business.

- Facilitates Faster Payments: Online payment options and automated reminders make it easier for your clients to pay you quickly.

How to Choose the Best Invoicing Software

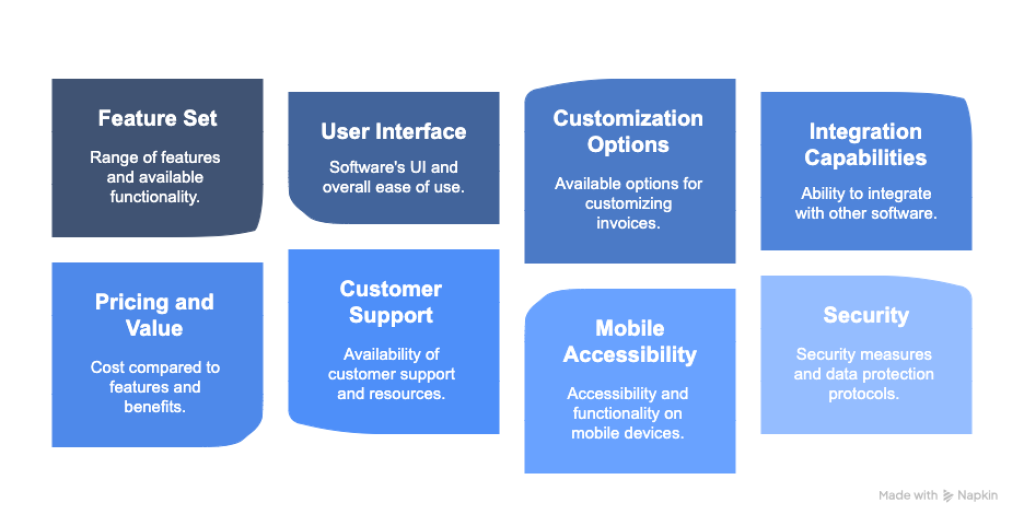

When selecting invoicing software, there are several factors to consider:

- Evaluate Your Business Needs: Consider your invoice volume and complexity to find a solution that fits your business.

- Look for Key Features: Customizable templates, payment integration, and automation capabilities are essential features to look for.

- Consider Scalability: Choose invoicing software that can grow with your business and accommodate future needs.

- Check for Integration: Ensure the software integrates with other business tools and accounting software you use.

- Assess Ease of Use: Look for a user-friendly interface that makes it easy to create and send invoices.

- Compare Pricing: Consider your budget and compare pricing plans to find the best value for your business.

Top Invoicing Software for 2025

Based on our research and evaluation, here are the top invoicing software options for small businesses in 2025:

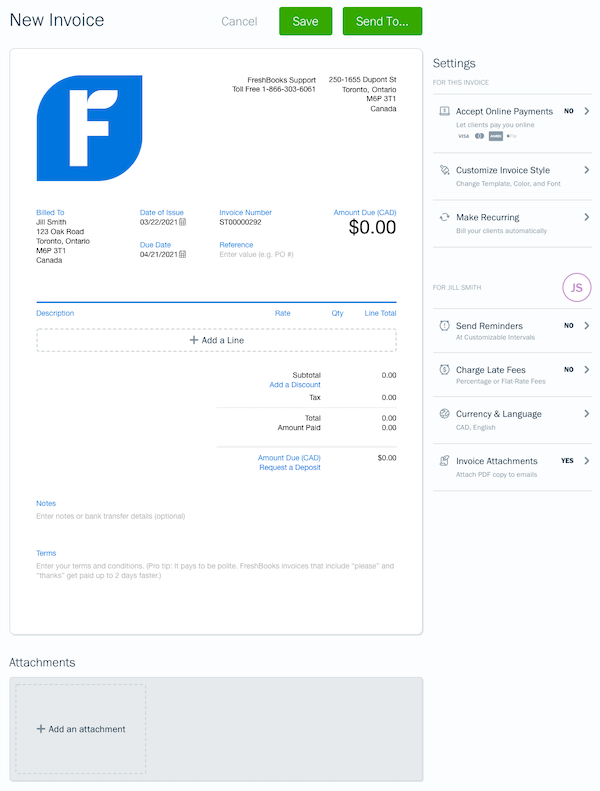

FreshBooks: Known for its intuitive interface, time tracking, and expense management features. It simplifies billing with recurring invoices, online payments, and automated reminders.

FreshBooks

Best suited for freelancers, solopreneurs, and small service-based businesses such as consultants, agencies, IT, legal, and marketing firms, especially those without inventory needs

Rasons to buy

- + Highly intuitive and user-friendly interface

- + Automation for recurring invoices and payment reminders

- + Strong project tracking capabilities

Possible Drawbacks

- –Basic inventory tracking only

- –Basic inventory tracking only

- ● Lite at $21/month (up to 5 clients)

- ● Plus at $38/month (up to 50 clients)

Zoho Invoice: Offers professional invoice templates, multi-currency support, time tracking, and robust automation—all at no cost.

Zoho Invoice

Best suited for freelancers, consultants, small business owners, solopreneurs, and contract workers who need a simple, efficient, and cost-effective way to manage invoicing, track time, and collect payments

Rasons to buy

- + Client portal for customers to view, pay, and interact with invoices and quotes

- + Supports multi-currency and multiple languages for global business

- + Automated recurring invoices and payment reminders t

- + Detailed business and financial reporting with 30+ report types

Possible Drawbacks

- –Some advanced features require technical skills

- –No direct integration with Zoho Inventory

- ● Free forever plan available

- ● Zoho One bundle available at $30/user/month

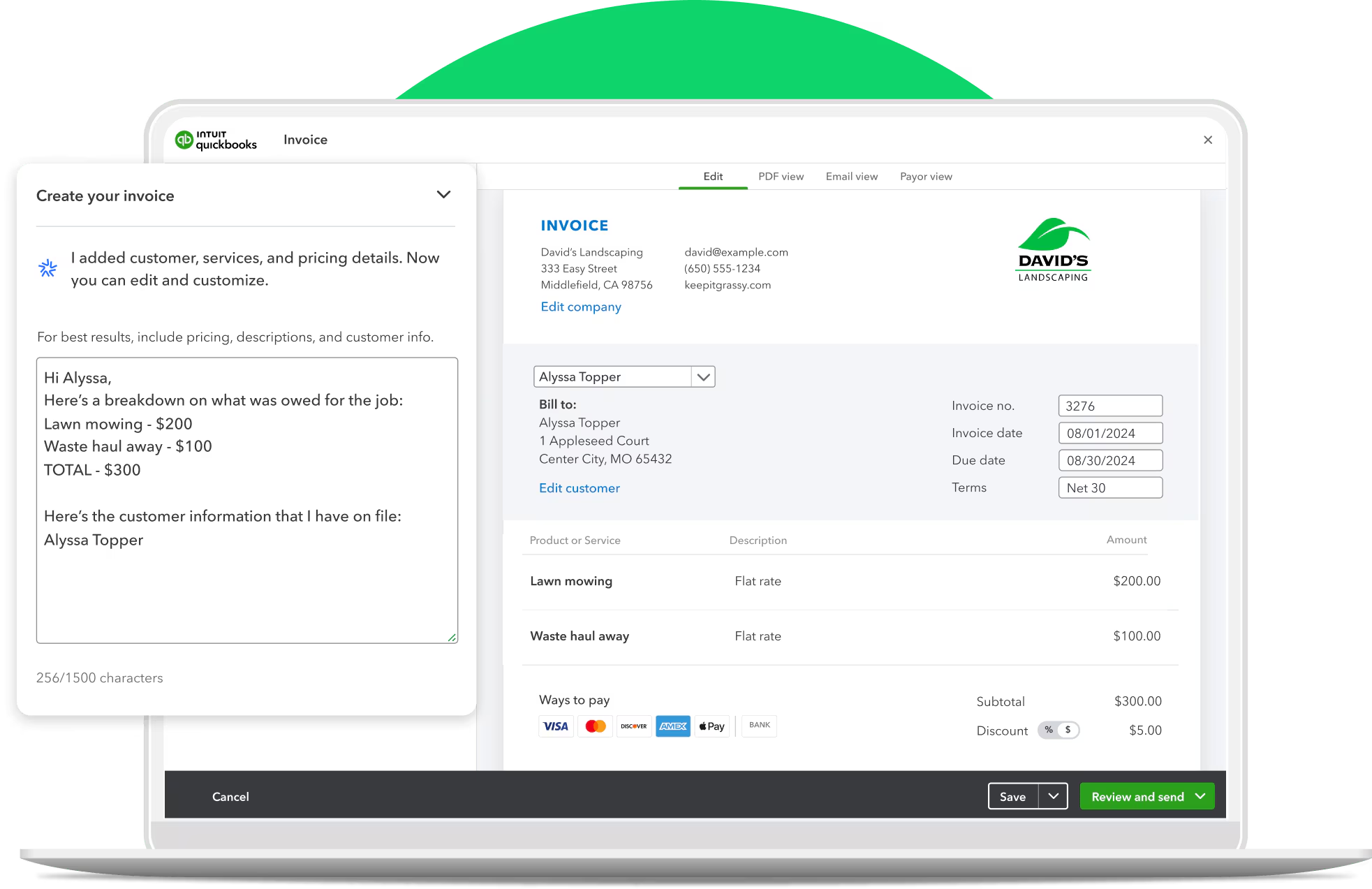

QuickBooks Online: Combines invoicing with full-service accounting. It supports inventory management, payroll, reporting, and integrates with hundreds of apps

Quickbooks

Best for small to medium-sized businesses across retail, e-commerce, professional services, construction, hospitality, freelancers, independent contractors, and wholesale distribution

Rasons to buy

- + Customizable invoice templates for professional branding

- + Mobile invoicing—create and send invoices from any device

- + Real-time invoice tracking and status alerts

- + Easy integration with 750+ business apps and POS systems

Possible Drawbacks

- –Limited advanced customization for complex invoice needs

- –Missing some industry-specific features and advanced automation

- ● Simple Start: $32.50/month

- ● Essentials: $32.50/month

Invoice2Go: Simplifies the process of sending professional invoices, tracking payments, and managing basic business finances.

Invoice2Go

Best suited for freelancers, solopreneurs, and small business owners who need simple, mobile-friendly invoicing and expense tracking without complex accounting features

Rasons to buy

- + Extremely user-friendly interface, ideal for non-accountants and quick setup

- + Mobile-first design for invoicing and payments on-the-go

- + Fast invoice creation, customization, and automated reminders to get paid quicker

- + Expense and time tracking, basic reporting, and client management

Possible Drawbacks

- –Limited advanced customization and automation options

- –Fewer integrations and reporting features than comprehensive accounting platforms

- ● Starter: $5.99/month

- ● Professional: $9.99/month

How We Evaluated the Best Invoice App For Small Business

To determine the best invoice software for small businesses, we evaluated each option based on the following criteria:

Pros and Cons of Invoicing Software

Like any technology, invoicing software has its advantages and disadvantages. Here are some pros and cons to consider:

Pros:

- Improved efficiency and time-saving

- Enhanced accuracy and reduced errors

- Better cash flow management

- Professional appearance and branding

- Automated reminders and faster payments

Cons:

- Initial costs, especially for small businesses or freelancers

- Learning curve for new users

- Dependence on technology and potential technical issues

- Possible limitations in customization for basic plans

FAQs on Invoicing Software

- What is invoicing software? Invoicing software is a program that generates bills for products or services, creating professional invoices that can be sent electronically or printed.

- How does invoicing software improve cash flow? It automates invoice creation and delivery, sends payment reminders, and offers online payment options, leading to faster payments.

- Is invoicing software suitable for all business sizes? Yes, there are options available for businesses of all sizes, from freelancers to large enterprises.

- Can invoicing software integrate with accounting systems? Many invoicing software options offer integration with popular accounting systems like QuickBooks and Xero.

- What are the costs associated with invoicing software? Costs vary, with some offering free plans and others charging monthly fees. Many also charge transaction fees for online payments.

Related Resources and Support

If you need additional support or want to learn more about invoicing software, here are some helpful resources:

- Vendor websites often provide extensive documentation, tutorials, and customer support

- Online communities and forums for users to share tips and troubleshoot issues

- Industry blogs and publications offering insights on invoicing best practices

- Webinars and video tutorials demonstrating software features and use cases

- White papers and case studies showcasing successful implementations

By leveraging the power of invoicing software and choosing the best invoice app for your small business, you can streamline your billing process, save time, and improve your financial management. With the right tools and support, you’ll be well on your way to success in 2025 and beyond. Consider trying out a market intelligence tool or marketing intelligence platform to gain valuable insights into your industry and make data-driven decisions for your business.