When the Lights Went Dark for Eight Weeks

A regional apparel retailer with three locations faced a brutal third quarter in 2024. Foot traffic had dropped nearly 30 percent compared to the previous year, and the owner watched daily receipts shrink while fixed costs remained stubbornly high.

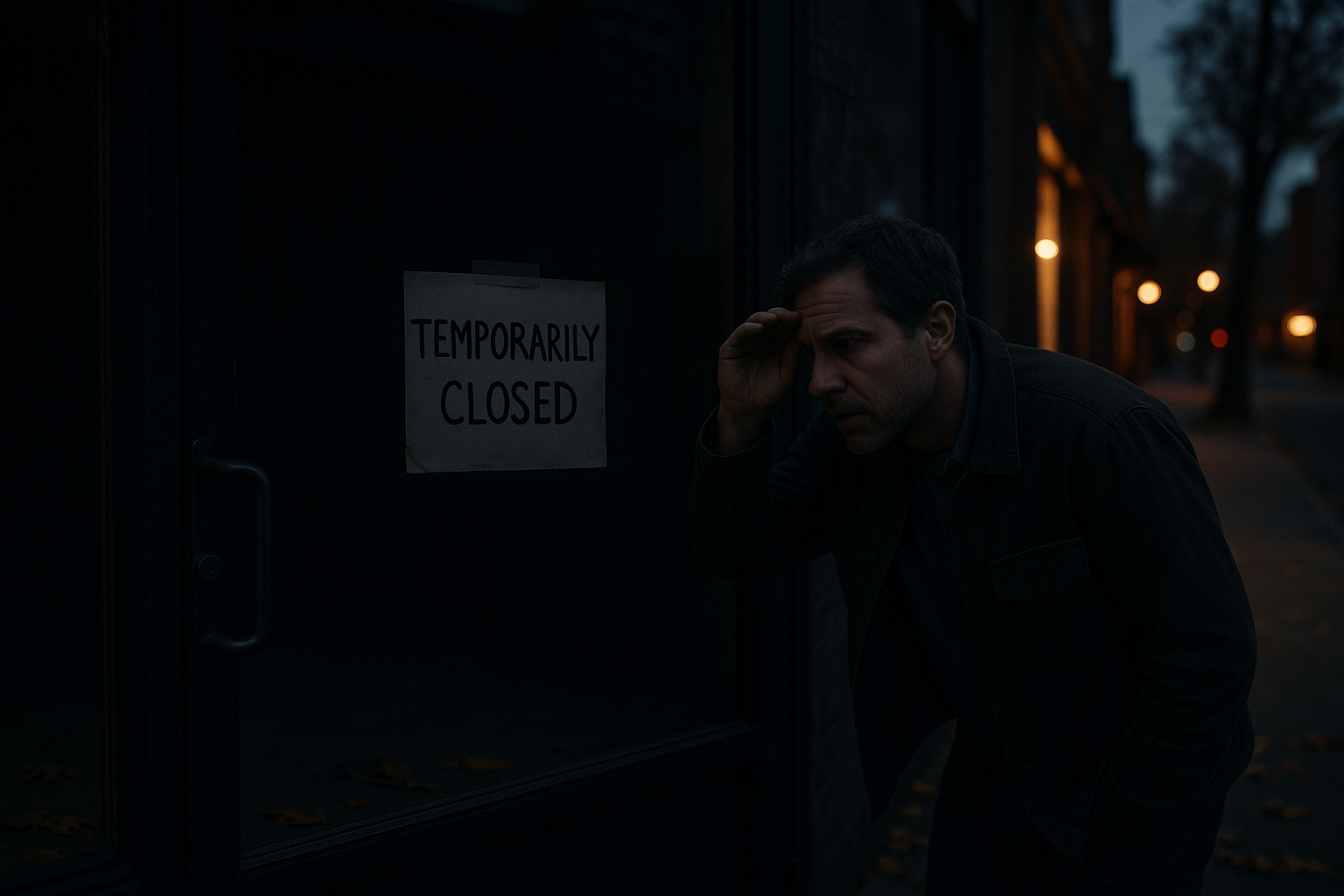

By mid-August, the decision seemed obvious—close the smallest location for eight weeks, cut payroll and utilities, and reopen when the holiday shopping season arrived. The math appeared simple: roughly $18,000 in rent and utilities saved, plus another $22,000 in payroll costs eliminated. The owner locked the doors in early September with a handwritten sign promising to return in November.

The closure happened during a period when the broader retail sector was contracting sharply. The U.S. retail industry experienced a 12 percent increase in store closures in 2025 compared to 2024, with approximately 15,000 closures tracked across the year, according to Coresight Research.

While 2024 had already seen 7,325 closures against only 5,970 openings, resulting in a net loss of 1,355 stores, many of those decisions were reactive attempts to reduce expenses during difficult quarters. The retailer’s owner believed the temporary shutdown would provide breathing room without permanent damage.

The Customer Exodus

Within two weeks of the closure, regular customers began appearing at the darkened storefront, peering through the windows and walking away confused. One longtime customer who had spent roughly $7,500 annually at the location for four years drove across town specifically to shop there one Saturday morning.

She found the doors locked and the interior lights off. No one answered the phone number listed on the door sign. She walked two blocks to a competitor’s store and bought what she needed there. She never returned to the original location after it reopened.

The owner later estimated that between 15 and 20 regular customers defected permanently during the closure. According to retail analysts tracking the consumer shift toward price sensitivity and convenience, temporary closures create the perfect moment for customer defection because they force shoppers to establish new purchasing patterns.

The lost customer lifetime value from those defections exceeded $90,000 over a five-year projection. That figure alone wiped out the savings from closing and created a revenue hole that persisted well into the following year.

The Team That Disappeared

The store had employed four part-time sales associates and one full-time assistant manager. When the owner announced the eight-week closure, three of the part-time employees immediately began looking for other work.

The assistant manager, who had been with the company for six years and knew the inventory systems and customer preferences intimately, accepted a position at a nearby home goods store within ten days. By the time the location reopened in November, only one original employee remained available to return.

Rebuilding the team required:

- Posting job listings and screening candidates

- Conducting interviews for multiple roles

- Training new hires on point-of-sale systems

- Onboarding staff into inventory management workflows

- Reinforcing customer service protocols and expectations

The owner spent nearly $6,000 on recruitment and training costs, plus another $4,500 in lost productivity as new staff learned the systems.

More damaging was the loss of institutional knowledge. The former assistant manager had maintained informal relationships with dozens of repeat customers and knew their preferences and purchasing histories. That knowledge walked out the door and never came back.

Research from retail operations experts confirms that employee retention and institutional knowledge are critical operational assets, particularly for small retailers competing against larger chains with standardized processes.

The Competitor Advantage

During the eight-week closure, two nearby competitors ran targeted promotions and extended their operating hours to capture back-to-school and early fall shoppers. One competitor opened a new fitting room area and promoted it heavily on social media, attracting customers who previously shopped at the closed location.

When the retailer reopened in November, foot traffic remained 40 percent below pre-closure levels despite aggressive promotional discounts and increased advertising spending.

The owner spent $8,500 on reopening marketing, including:

- Paid social media ads to reach prior customers

- Direct mail postcards announcing the reopening

- In-store promotional discounts and limited-time offers

Even with that investment, many customers who had shifted to competitors during the closure did not return. The market positioning that had taken years to build eroded in just two months.

Competitors had capitalized on the absence and captured both shelf space in customers’ minds and actual purchasing loyalty.

The Hidden Math

By the time the owner calculated the full impact six months after reopening, the temporary closure had cost the business far more than it saved.

The initial savings of $40,000 were offset by:

- $90,000 in lost customer lifetime value

- $10,500 in recruitment, training, and lost productivity costs

- $8,500 in reopening marketing expenses

Revenue at the location remained depressed through the first quarter of the following year, creating an additional opportunity cost that compounded the damage.

The owner restructured operations for the next slow period by:

- Reducing hours rather than closing entirely

- Cross-training staff from other locations to cover shifts

- Maintaining a visible presence even during low-traffic weeks

The lesson had been expensive but clear—staying open with reduced operations preserved customer relationships, retained trained employees, and prevented competitors from gaining ground.

The true cost of closing had been nearly three times the initial savings, and the business was still recovering months later.