Key Takeaways:

- Payroll software automatically deals with taxes, direct deposits and the rules set by Canada’s tax authorities.

- Wagepoint, Humi, Payworks, ADP and Deel are good options and the prices start at $20 per month or can be custom set for enterprises.

- When choosing software, you should take into account the size of your business, which industry you are in and your expansion plans worldwide.

- Must-have features are: automatic tax processing, letting employees get paid through direct deposit, managing compliance and easy integration with other software.

- Prevent problems by putting compliance, compatibility, required features and quick customer service at the top of your list.

Automate & Simplify Payroll Management

If you run a business in Canada, you are aware that managing payroll can be both difficult and time-consuming. Since you have to follow both federal and provincial tax rules, calculate your deductions and make regular payments, it’s simple to feel stressed. That’s where using payroll software helps – it handles the routine work, makes sure you comply with rules and allows you to focus on your business goals.

We have put together a fresh comparison of the five best payroll software options for Canadian businesses in 2025. No matter if you’re just starting out or a major company, there’s something that fits your requirements.

Top 5 Canadian Payroll Software Solutions: Pros and Cons

Using the right payroll system can make payroll easier, keep things compliant and give you more time. So you can decide with confidence, we’ve put together a detailed list of the Best Payroll Software for Canadian Businesses.

Choosing the suitable payroll software is influenced by the number of employees, the budget and what you need from your HR team. I’ve created this comparison of the leading options to use in Canada.

Wagepoint: An easy and low-cost payroll service designed for Canadian small business owners. Perfect for making tax filings, payment deposits and T4s automatic.

Wagepoint

Wagepoint is best suited for small and medium-sized businesses, particularly those with up to 100 employees, focusing on straightforward payroll needs.

Rasons to buy

- + Easy-to-use interface and setup

- + Integrates with popular accounting software like QuickBooks and Xero

- + Handles payroll compliance and tax remittances automatically

- + Offers flexible payment options and employee self-service portal

- + Strong customer support

Possible Drawbacks

- –Limited advanced HR features compared to competitors

- –May not be suitable for complex payroll needs or large enterprises

- –Customer service is not available 24/7

- ● Solo Plan: $20/month base fee plus $4 per employee or contractor.

- ● Unlimited Plan: $40/month base fee plus $5 per employee or contractor.

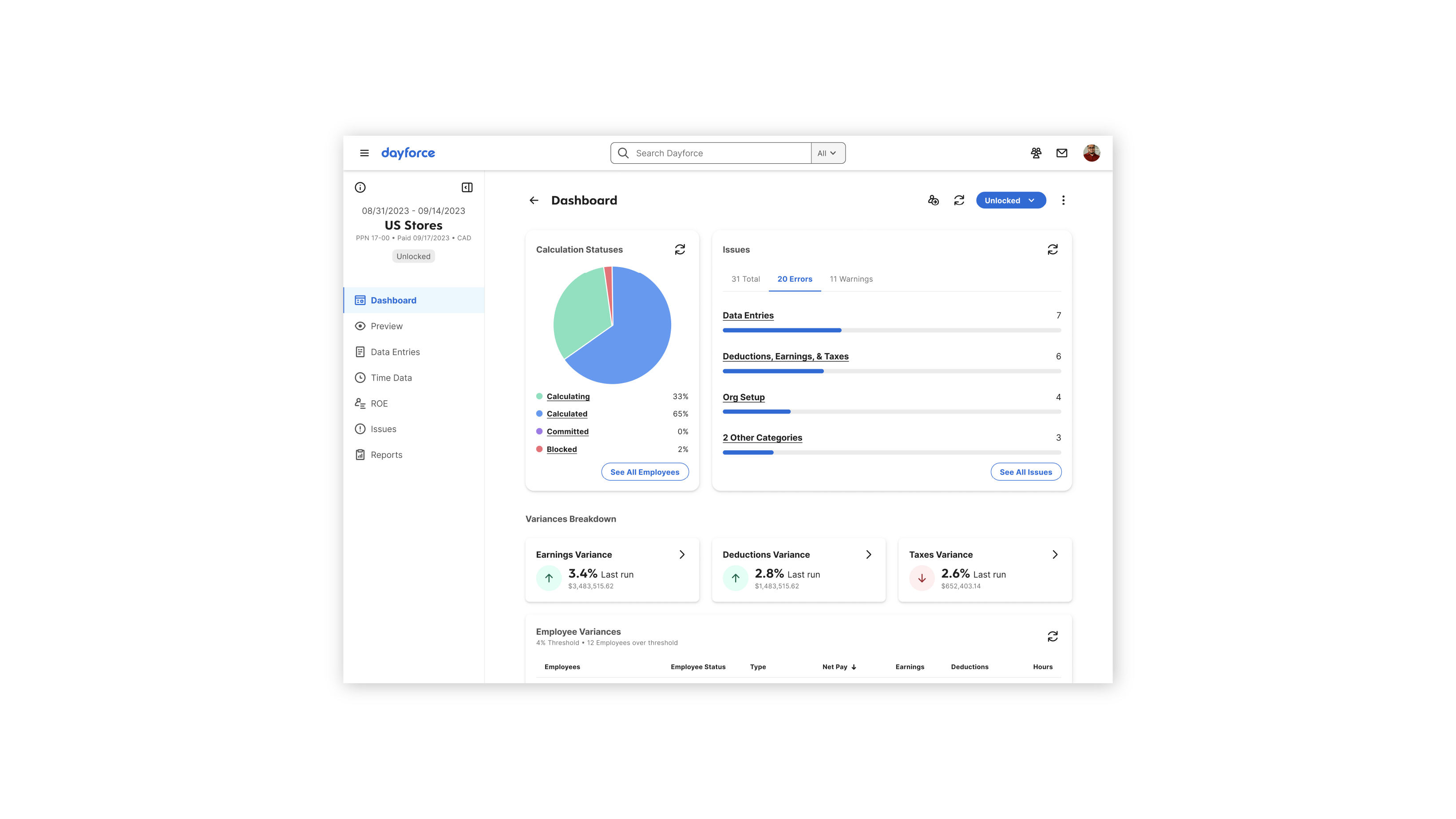

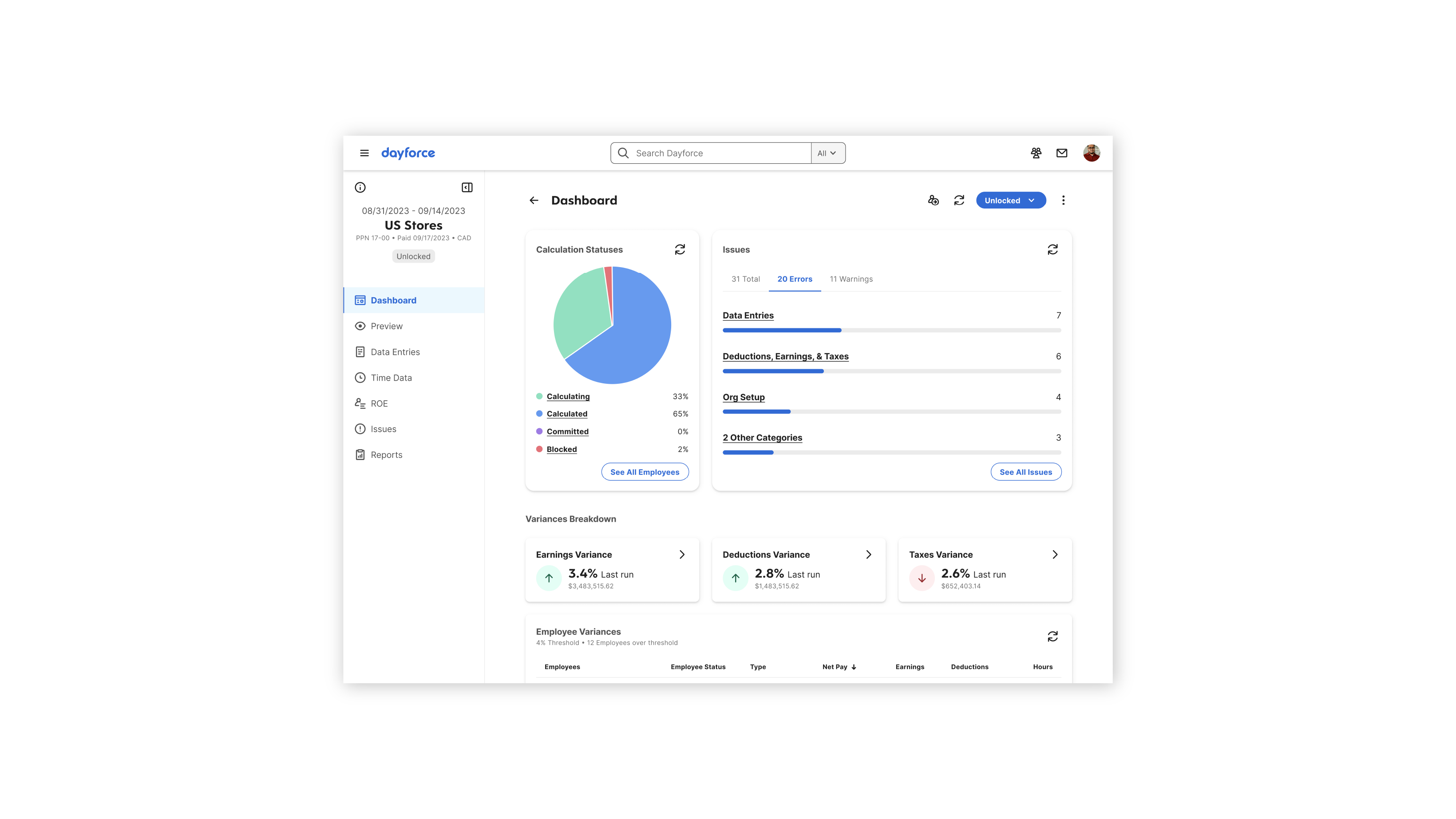

Dayforce: Created for large organizations, it has strong payroll, HR and compliance features.

Dayforce

Dayforce is best suited for mid-to-large businesses with complex payroll, compliance, and workforce management needs, particularly those with global operations.rnrn

Rasons to buy

- + Integrated HCM platform combining HR, payroll, benefits, talent management, and workforce management

- + AI-driven insights for informed decision-making

- + Employee self-service options

- + Global payroll capabilities

Possible Drawbacks

- –Manual retro pay calculations

- –Limited calendar integration

- –Slow load times for some features

- ● Pricing is generally considered on the higher end

Payworks: Payworks is a Canadian company that supports its community, providing dependable tools for payroll, HR and time management that fulfill compliance needs

Payworks

Payworks is best suited for small to large-sized businesses across various industries,Payworks

Rasons to buy

- + Provides a comprehensive suite of workforce management tools

- + Known for exceptional customer support

- + Automates payroll calculations and compliance management

- + Integrates seamlessly with accounting systems

Possible Drawbacks

- –Limited global payroll capabilities

- –Some features are optional add-ons

- –Pricing can vary significantly

- ● Pricing is primarily per pay run

- ● Base fee of approximately $20.90 plus $2.10 per employee.

- ● Special bundles and discounts may be available

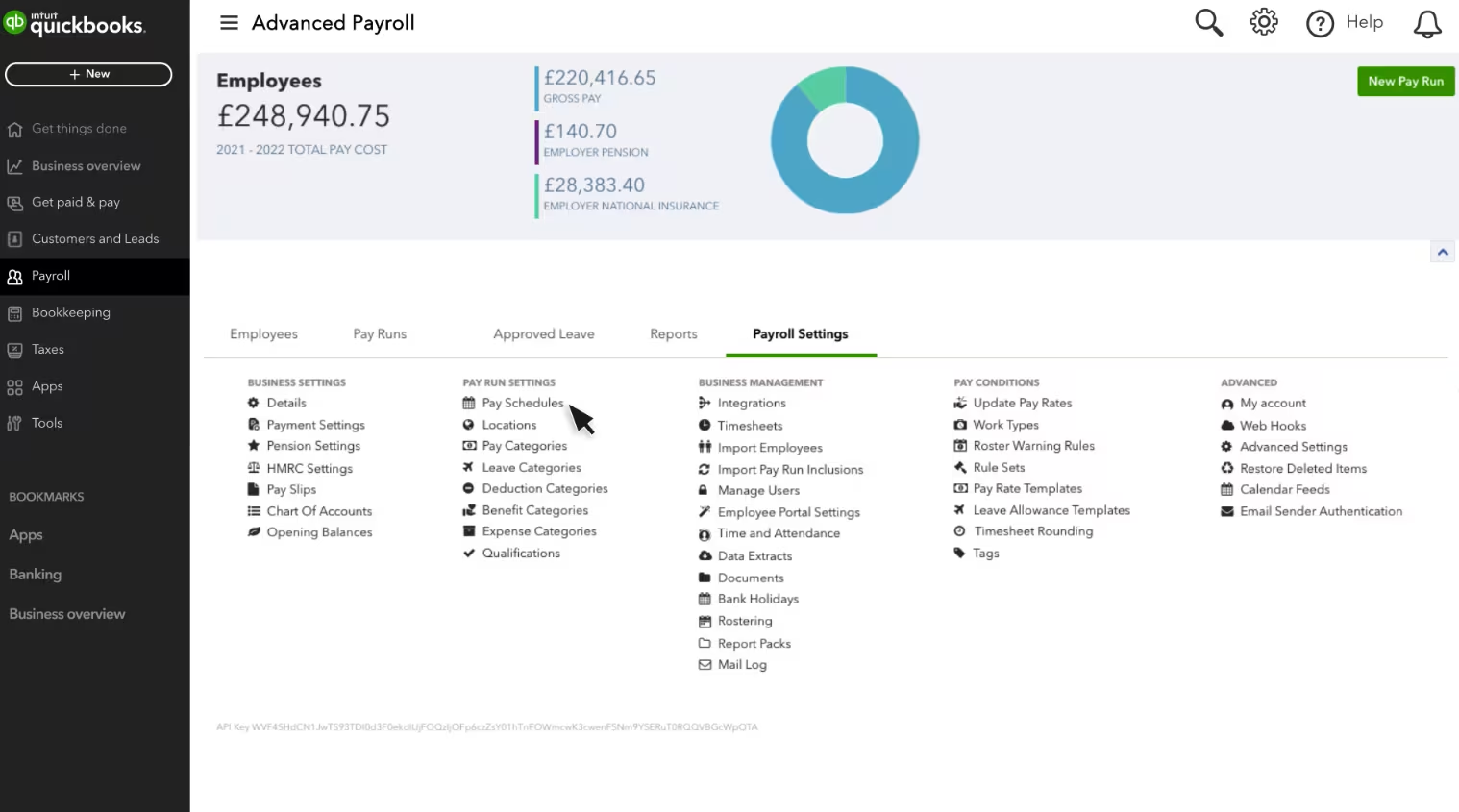

QuickBooks Online Payroll: For businesses that use QuickBooks, QuickBooks Online Payroll makes payroll smooth and lets you file taxes automatically.

QuickBooks Online Payroll

QuickBooks Online Payroll is ideal for small to midsize businesses, including accountants, financial experts, nonprofits, construction companies, and restaurants.

Rasons to buy

- + Automates payroll processes with customizable pay schedules

- + Offers fast direct deposit options

- + Integrates time tracking

- + Includes features for filing and paying taxes electronically

- + Offers comprehensive payroll reports

Possible Drawbacks

- –Limited HR features

- –Higher monthly base price compared to some competitors

- ● Payroll Core: $25/month base fee + $4/employee/month

- ● Payroll Premium: $55/month base fee + $8/employee/month

- ● Payroll Elite: $80/month base fee + $15/employee/month

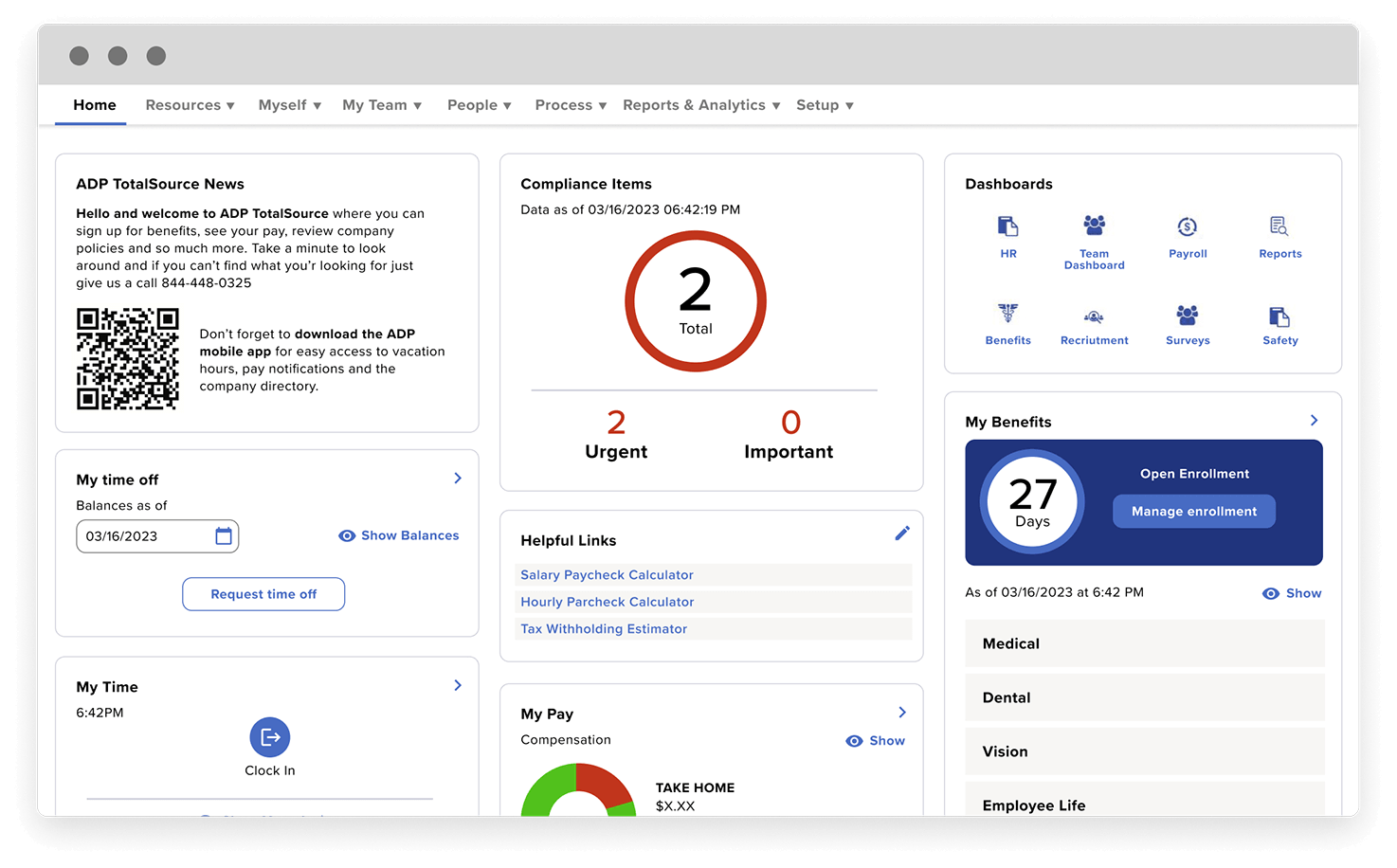

ADP Canada: ADP Canada is a flexible service that works for businesses of all sizes and includes modern payroll and HR tools for global use.

ADP Payroll Canada

Best suited for small to large businesses across various industries, offering scalable solutions for businesses with 1-49 employees up to multinational corporations.ayforceQuickBooks Online Payroll

Rasons to buy

- + Comprehensive payroll and tax compliance services

- + Integration with time and attendance tracking

- + Scalable HR solutions with advanced analytics

- + Expert support and compliance management

- + Bilingual support

Possible Drawbacks

- –Some users report issues with customer service

- –Pricing is not transparent and requires a quote

- ● Pricing varies based on business size and needs

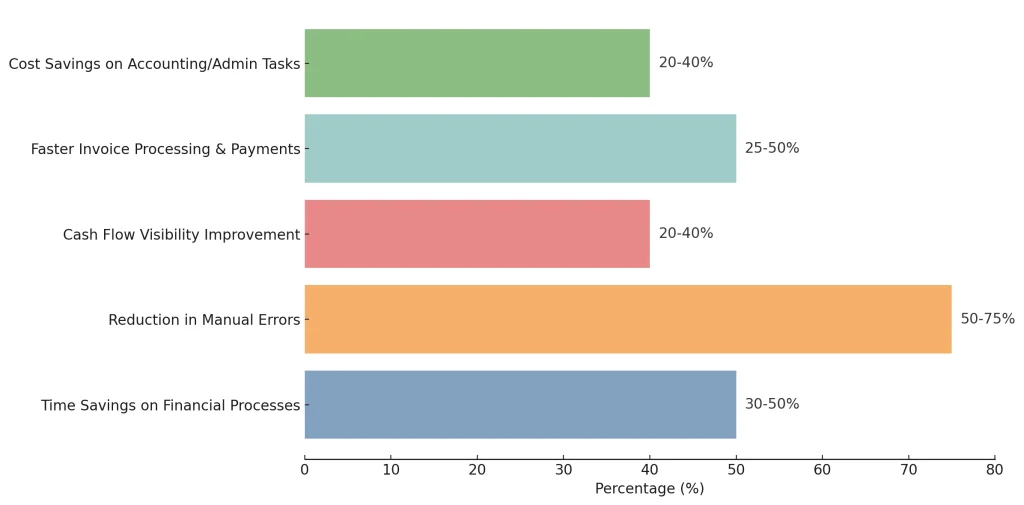

Key Metrics That Show How Payroll Software Drives Efficiency

The real benefits of accounting software are shown by the numbers. The following details the main metrics that explain how these tools boost efficiency, cut down on errors and simplify financial procedures.

Choosing the Right Software to Process Payroll: The Essential Features of an All-in-One Payroll Solution

Since there are many payroll software options around, how do you know which one is best for your business? The first thing to do is list these essential features in order of priority.

- Automated Tax Calculations: The software is able to calculate the taxes and deductions for federal, provincial, CPP and EI programs, following the newest rates.

- Direct Deposit: Check if your solution allows for direct deposit which helps you process payments without the need for manual checks.

- Compliance Management: The software should automatically keep up with CRA’s new rules and submit your tax filings.

- Employee Self-Service Portals: With an Employee Self-Service Portal, staff can access their wages, tax paperwork and personal info on the web.

- Integration Capabilities: Check if the software is able to share data smoothly with your financial tools (like QuickBooks) and time-tracking systems.

- Reporting & Analytics: You can run and customize reports on payroll costs, patterns and other data to better see how your business works.

- Bilingual Support: If your team speaks both English and French, seek out software that has both languages as interfaces.

- Global Payroll Support: If your business works in different countries or hopes to in the future, Deel is an option that handles payroll for multiple countries.

Pricing Comparison: Best Payroll Software in Canada for 2025

Prices for payroll software change a lot depending on how many employees which features are included and what level of help is available. Let’s look at the most popular choices for each price range:

- If you are a small business, Wave Payroll ($20/month) and Wagepoint ($2.50/employee and base fee) are options to consider.

- Payworks ($20.90/month + $2/employee) and Knit People ($39/month flat) offer users more features for a competitive price.

- Custom pricing (starting at $1,300+ yearly) from ADP and Sage is offered for complex business needs.

- Deel charges $49 per month for handling contractors and $599 per month for the employer of record (EOR) role, so it is a leading option for businesses with international teams.

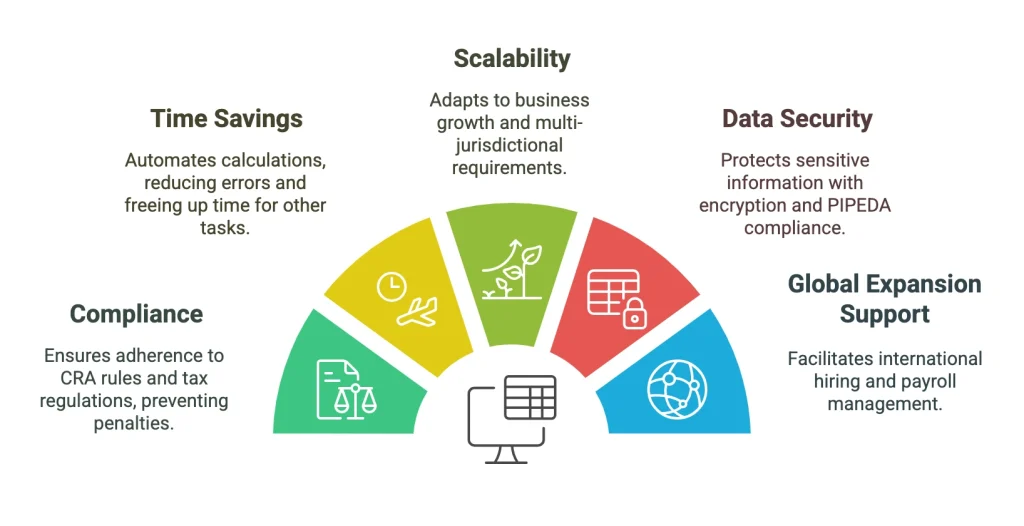

Benefits of Using Payroll Software in Canada

The right solution, no matter the company size, can help you save valuable time, lower the number of mistakes and make your employees happier. This is what makes it worthwhile:

Pitfalls to Avoid When Choosing Payroll Software

To select the best payroll software for your Canadian business, avoid these usual problems.

- Forgetting Compliance: Software should update tax rates and CRA regulations automatically so you don’t end up paying penalties.

- Integration Gap Issue: Choose a payroll solution that will easily connect with your other HR and accounting tools so that data remains unseparated.

- Choosing an Option Based on Price: Sometimes, you pay a bit more for important features like support in different languages or handling payroll around the globe. Think about your business in its entirety.

- Bad Customer Support: Select a company that has responsive support from Canada, so you get help when you really need it.

- Failing to Future Proof Your Needs: Be sure to choose a tool that can support your international hiring ambitions.

FAQs About Canadian Payroll Software

- Can payroll software handle multiple provinces? Most reliable tools can handle provincial taxes such as the Ontario EHT and QPP without requiring extra setup.

- Is electronic ROE filing supported? Tools such as Payworks, Knit People and Deel handle the submission of ROEs to make your reporting easier.

- How much does payroll software cost? If you want Wave, you can pay $20 each month, but if you use ADP, you will need to pay the company’s custom rates for enterprise services. The majority charge a base amount and then a charge per employee. While Deel costs more to begin with, it allows you to pay employees in many different countries.

- Does payroll software support bilingual interfaces? There are plenty of options, including Rise People, Humi and others, that let you use their platform in English or French to help your diverse team.

- Can these solutions handle international payroll? Since many Canadian payroll tools are limited to one country, businesses with global ambitions should choose Rippling, Deel or Papaya Global which can handle payroll for employees in several countries.

Final Thoughts: Which Payroll Software Is Best for Your Business?

Ultimately, the best Canadian payroll software for your business will depend on your unique needs, size, and growth plans. Here’s what I recommend depending on the situation:

- Small teams can find that Wagepoint and Wave Payroll are both easy to use and inexpensive.

- For supporting your SMEs growth, Humi or Knit People offer HR and payroll solutions as a package.

- For complex firms, ADP and Sage supply the flexibility and all-in-one functions needed for their size.

- Scheduling and managing tips are both available for restaurants and retail businesses in the Push Operations industry.

- Deel or Rippling help companies with international employees handle their payroll more easily.

Businesses in Canada that stay within their own borders usually find that Payworks and Rise People are both reliable and easy to use, while being very affordable. If your company plans to do business outside your home country or has employees from other nations, Deel’s wide-ranging platform is worth the added cost.

Before proceeding, try out the software by scheduling a demo or using a trial to see if it fits your team’s methods. Having the right payroll software means you can organize your processes better, stay compliant and spend more of your time expanding your Canadian business.