Key Takeaways:

- Musicians encounter financial problems that call for accounting software designed for them

- Important features include: cloud storage, an easy-to-use interface, income/expense monitoring, billing, tax handling, generating reports and linking to your bank.

- You should update your accounts often, use the cloud, set up automatic data entry, make use of reporting tools and explore possible integrations.

- To budget well, check your past expenses, separate them into categories, save at least 20% and plan for both taxes and future investments

- Keep all your paperwork, claim what you are allowed to deduct, hire an accountant who knows tax laws and keep your financial statements updated.

- With the proper software and strong financial habits, musicians can control their finances, make smart choices, feel less stressed, concentrate on their music and establish a lasting business.

The Best Accounting Software for Musicians: Take Control of Your Finances

As a musician, you give everything you have to your music. When you’re busy creating, managing your finances can be the last thing on your mind. So, accounting software is useful – it’s made for musicians like you, helping you manage your finances easily so you can concentrate on your music.

Why Musicians Need Accounting Software

We all know that managing your finances as a musician is not easy. You are working with several sources of income—from gigs, selling merchandise and royalties—and have to handle a changing work schedule and income. There’s a lot to remember when you study!

That’s the reason musicians rely on accounting software. These tools break down financial management, making it easier for you.

- Make sure to keep track of your earnings and your spending.

- Deal with your changing work schedule and income.

- Make it easy to follow tax rules and take advantage of real deductions.

- Make professional invoices for every gig and service you provide

- Get a clear picture of your finances so you can decide what to do next

All in all, the best software for musicians helps you manage your finances, so you can focus on your music.

Top Accounting Software Options for Musicians

So which is the best accounting software for artists? Here are a few of the top and most popular choices:

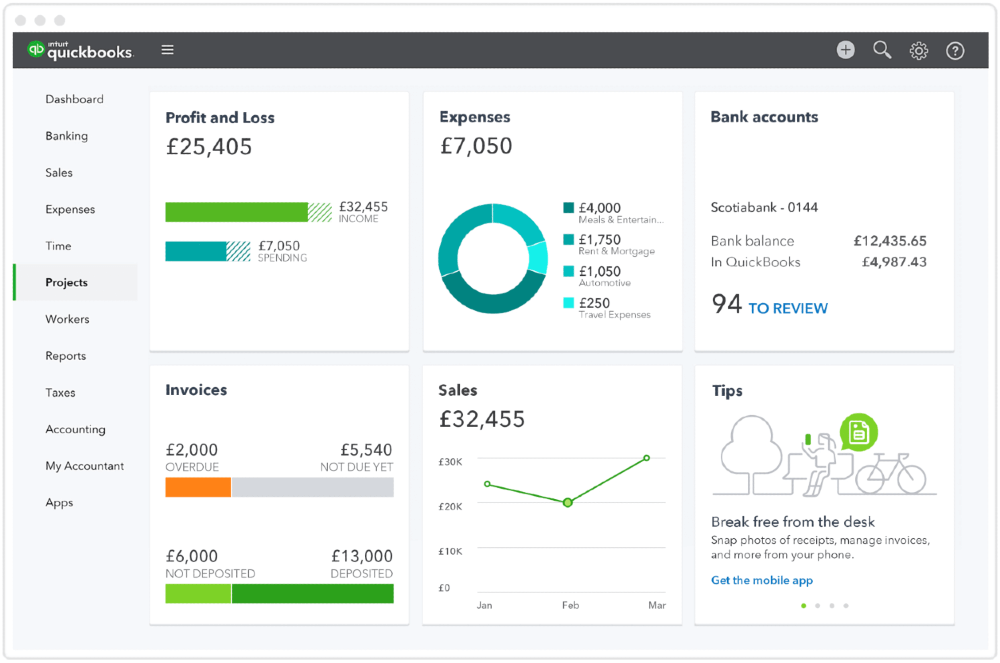

QuickBooks: QuickBooks is widely chosen by artists due to its many features, simple design and ability to grow with your career.

Quickbooks

Best suited for small businesses, freelancers, startups, and mid-sized companies across various industries like retail, construction, and professional services

Rasons to buy

- + User-friendly interface with real-time financial tracking and reporting

- + Automates tasks like invoicing and reporting

- + Provides robust inventory tracking and customizable reports

- + Integrates seamlessly with third-party apps

Possible Drawbacks

- –File size and user limitations may hinder scalability for larger operations

- –Limited customization options and industry-specific functionalities

- ● Plans range from $20/month

- ● Payroll add-ons start at $50/month

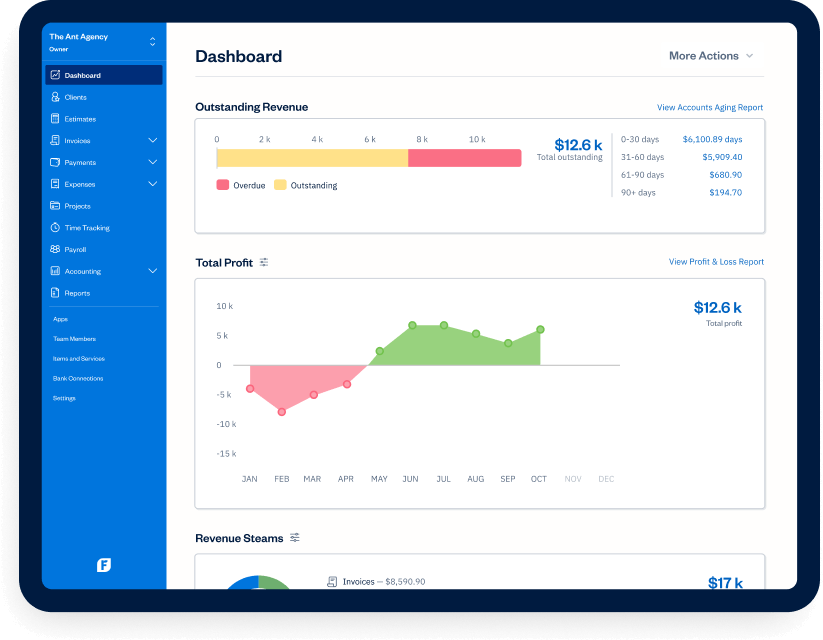

FreshBooks: is designed with strong features for freelancers and small businesses which makes it ideal for independent musicians.

FreshBooks

Best suited for small business owners, freelancers, and service-based businesses with limited inventory needs. It caters to industries like consulting, creative services, and IT, focusing on businesses with up to 25 employees

Rasons to buy

- + User-friendly interface, ideal for non-accountants

- + Customizable invoicing with time tracking

- + Mobile app for managing finances on the go

- + Automated expense tracking and payment reminders

- + Integration with third-party apps (e.g., Stripe, PayPal)

Possible Drawbacks

- –Limited inventory management capabilities

- –Steep learning curve for some users

- –May be slow performance with large data volumes

- ● Lite Plan: $21/month (5 clients)

- ● Plus Plan: $38/month (50 clients)

Wave: If you’re looking for a free or low-cost music platform, it’s a reliable choice for musicians.

Wave

Ideal for small businesses, freelancers, startups, service-based businesses, and online businesses with straightforward financial needs

Rasons to buy

- + Free accounting tools including invoicing, expense tracking, and receipt scanning

- + Multi-currency support for international sales

- + Mobile app for invoicing on-the-go

- + Option to hire professional bookkeepers for additional support

Possible Drawbacks

- –Limited scalability compared to competitors like QuickBooks

- –Payroll features only available in the US and Canada

- –Customer service restricted to chat

- –No built-in third-party integrations

- ● Pro plan costs $16/month,

- ● Receipt scanning ($8/month), payroll ($20-$35/month + $4/employee)

- ● Bookkeeping services ($149/month)

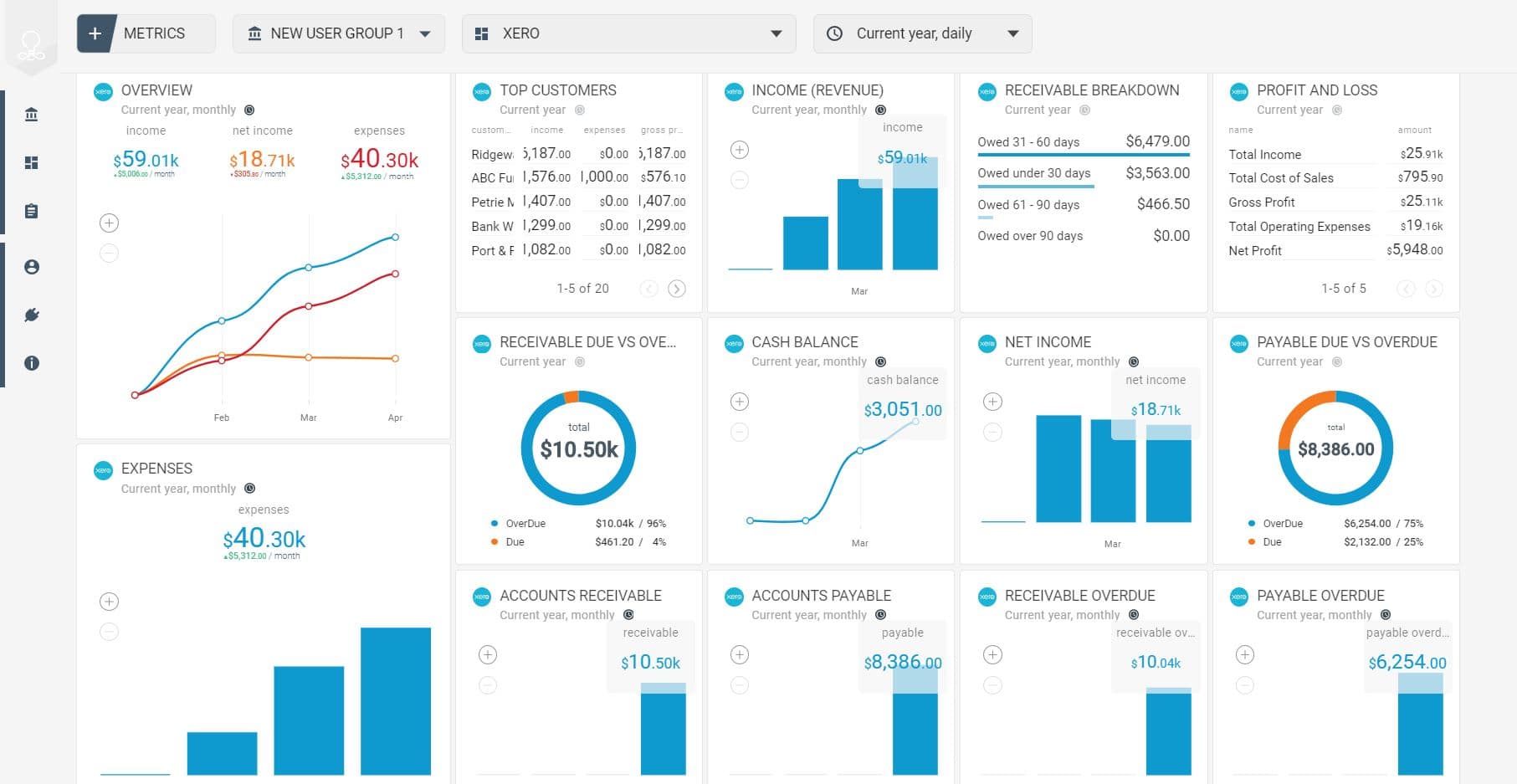

Xero: Xero offers musicians strong forecasting features and easy e-commerce integration.

Xero

u003cp style=u0022text-align: left;u0022u003eIdeal for small businesses, startups, freelancers, accountants, and bookkeepers seeking efficient, user-friendly cloud-based accounting solutionsu003c/pu003ernu0026nbsp;

Rasons to buy

- + Unlimited users across all plans

- + Simple setup and intuitive design with minimal learning curve

- + Strong invoicing, expense tracking, and bank reconciliation features

- + Multi-currency support in premium plans

Possible Drawbacks

- –No direct customer support calls

- –Entry-level plan restricts invoices and bills

- –Unsuitable for large businesses with high transaction volumes

- ● Early Plan: $15/month

- ● Growing Plan: $47/month

Key Features to Look for in Accounting Software for Musicians

As a musician choosing accounting software, there are some important features you should pay attention to first.

- Cloud-based accessibility: Managing your finances on the cloud means you can access your account from any place and at any time.

- Intuitive interface: Even if you aren’t an accountant, you can still master these tools. Choose software that is simple to use and easy to find your way around.

- Income and expense tracking: You need to be able to sort and watch your income and expenses to understand your finances.

- Invoicing capabilities: You can use invoicing to create professional invoices that help you get paid quickly and uphold your brand’s image.

- Tax management: Automated tax features help you easily manage and report your taxes.

- Financial reporting: Using dynamic reporting tools allows you to gain useful information on your finances.

- Bank synchronization: Automatic bank syncing means you don’t have to manually enter all your transactions.

- Integration with music industry tools: Choose accounting software for musicians that connects easily to the platforms you already depend on in the music industry such as Songtrust and Shopify.

Tips and Best Practices for Musicians Using Accounting Software

After you have picked the right accounting software, what can you do to use it effectively? Let’s look at a few tips and best ways to handle this:

- Stay on top of bookkeeping: Keep your accounting up to date by often updating and checking your records.

- Embrace the cloud: Use online access to your finances and check your data in real time from any location.

- Automate what you can: Automate as many tasks as you can by using the built-in automated features in your software.

- Dig into the data: Regularly review your reports to discover how your company is doing financially.

Connect the dots: Check how your accounting software can be linked with important tools you use in the music industry.

Budgeting and Financial Planning for Musicians

In addition to using accounting software, musicians should be good at budgeting to handle unpredictable earnings. This is how you can develop a strong financial plan:

- Know your numbers: Check your past finances to find out where your money is going and see what you can do better.

- Categorize your costs: Sort your costs into things you need such as rent and utilities and things you want such as eating out.

- Build your safety net: Save at least 20% of your earnings and change this amount as your circumstances develop.

- Plan for the future: Save some money for taxes, learning new skills and growing your music career.

- Separate your finances: Open bank accounts and use credit cards just for your music business.

Make the most of your tools: Put the budgeting and forecasting tools in your accounting software to good use when planning for the future.

Tax Tips for Musicians

Managing your taxes during tax season can be tough for musicians, but these tips will help you feel more confident.

- Keep track of everything: Make sure you record every penny you earn and spend during the year.

- Know your deductions: Be aware of the deductions allowed for musicians such as those for a home studio, buying instruments and travel.

- Don’t go it alone: It’s a good idea to find an accountant who is experienced in the music industry for advice.

Stay organized: Update your balance sheets and profit/loss reports often so that tax time isn’t as challenging.

Final Thoughts: Achieve Financial Freedom with the Right Tools

Being a musician, your most valuable qualities are your creativity and passion. Still, to succeed and earn a living in music, you must be organized with your money.

If you pick the right accounting software for musicians and use smart tips for managing your finances, you can:

- Improve how you handle your money in the future

- Choose the best actions to boost your music business.

- Don’t let finances cause you unnecessary stress or take up your time.

- Work harder on writing your own music and singing it live

- Build a strong base for your music career that will last over time

It’s important to understand that managing your finances is something you have to keep working on. Review the way you work from time to time and make changes as your career grows.

Having the proper tools and being proactive can help you build financial freedom as a musician which allows you to focus on your music and grow your career. Therefore, start today by checking out accounting for music industry and organizing your finances. You’ll be glad you made these choices in the future.