Shoppers Can Now Buy Inside AI Chats While Your Store Sits Invisible On The Sidelines

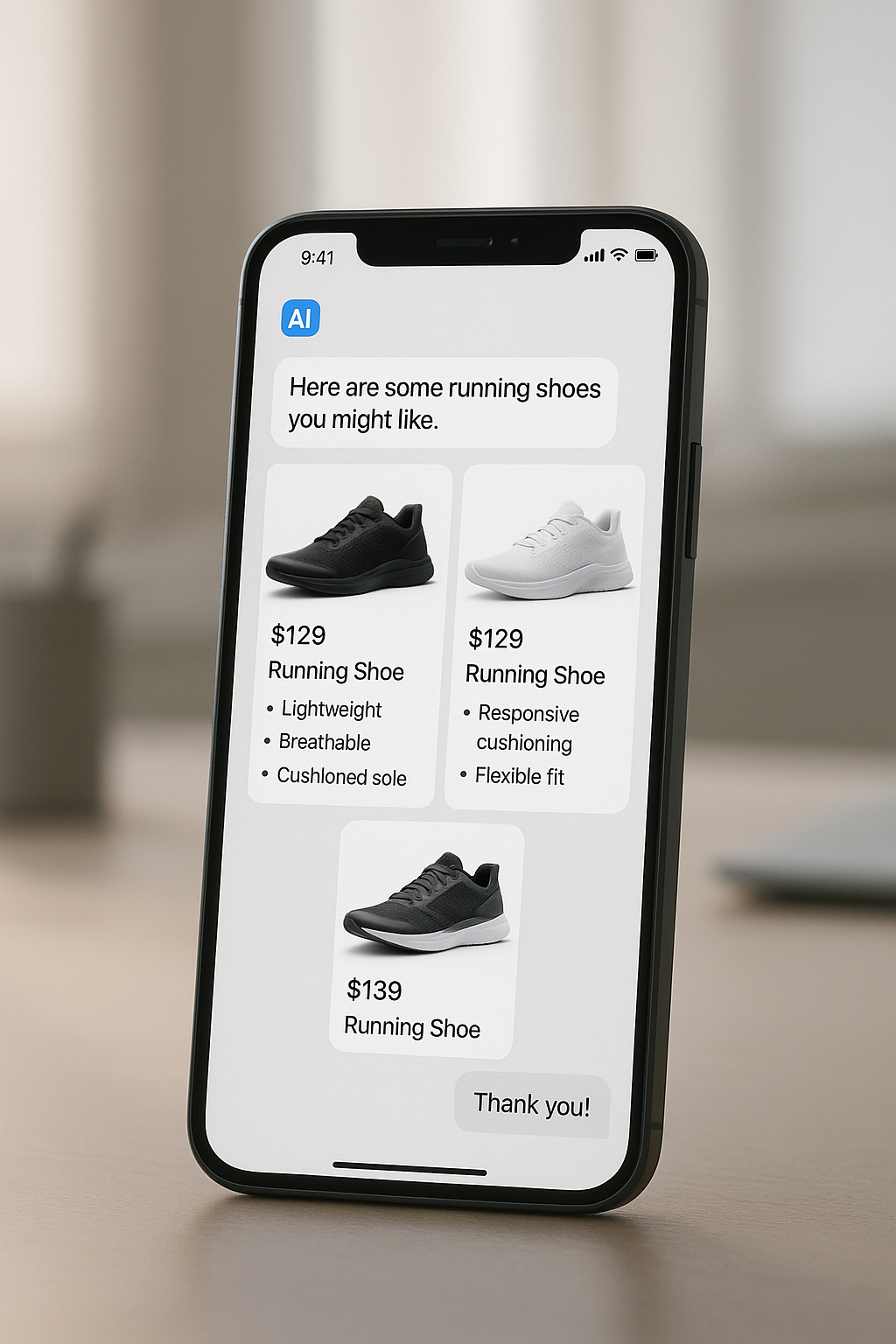

A customer opens ChatGPT, types “best running shoes for marathons,” and receives three tailored recommendations. They compare features, ask follow-up questions, and complete the purchase—all without leaving the conversation. Your store never appeared in that exchange, and your competitor just made the sale.

This scenario is becoming routine. AI chat platforms have evolved from simple question-answering tools into direct sales channels, and ChatGPT reached 400 million weekly active users by February 2025. Shoppers now discover, evaluate, and buy products inside conversational interfaces, bypassing traditional storefronts entirely. If your product catalog isn’t integrated into these systems, you’re losing customers before they know you exist.

How Shopping Inside ChatGPT and Copilot Is Becoming Normal

Direct in-chat purchasing represents a fundamental shift in retail. Platforms like ChatGPT, Microsoft Copilot, and Perplexity now support transactions within the conversation flow, combining product discovery, decision support, and checkout in one interface. Early-adopting brands have begun feeding their product data directly into these AI systems, ensuring their offerings appear when users ask for recommendations.

The trend is accelerating rapidly. 73% of consumers use AI in their shopping journey, including for product ideas, review summaries, and price comparisons. While only 13% have completed purchases via AI referrals so far, the trajectory is clear. The global conversational AI market is valued at $12.24 billion in 2024 and projected to reach $61.69 billion by 2032, according to market research. Customers appreciate the convenience of instant, personalized guidance without navigating multiple websites or comparing scattered product pages.

China offers a preview of this future, where platforms like WeChat already handle massive retail volumes through conversational commerce. Western markets are following the same path, with retail chatbot spending forecasted to hit $72 billion by 2028.

Why Traditional Retailers Are Being Left Behind

The visibility problem for conventional retailers is straightforward: if your products aren’t integrated into AI platforms, the algorithm can’t recommend them. Traditional ecommerce strategies focused on search engine optimization and paid ads, but AI chat operates differently. These systems prioritize structured product data and direct partnerships over web traffic metrics.

A sporting goods retailer might invest heavily in Google Shopping ads and SEO, but if their inventory isn’t accessible to ChatGPT’s recommendation engine, they won’t appear when a user asks for hiking boot suggestions. The customer defaults to whatever brands the AI does know about, often competitors who acted earlier. This creates a discovery gap that’s difficult to overcome once competitors establish their presence in these channels.

The financial stakes are substantial. AI in retail and e-commerce is projected to grow from $9.4 billion in 2024 to $85.1 billion by 2032 at a 31.8% compound annual growth rate. Retailers who delay integration risk permanent disadvantage as consumers develop loyalty to brands they consistently encounter in AI-driven shopping experiences.

The Operational Back Office

Managing product visibility across AI platforms requires clean, structured data—a challenge that exposes weaknesses in many retailers’ back-end systems. Digital customer service tools that centralize product catalogs, pricing, and inventory help retailers maintain the data quality AI systems demand.

E-commerce management platforms aggregate product information from multiple sources into standardized feeds that AI platforms can parse reliably. These systems reduce the manual work of updating product descriptions across channels and ensure consistent, accurate information. Retailers using fragmented spreadsheets or siloed databases struggle to meet the technical requirements for AI integration, while those with unified back-office systems adapt more quickly.

Three Ways Brands Are Selling Inside AI Chats

Forward-thinking retailers use direct platform partnerships to integrate their product catalogs with AI providers like OpenAI and Microsoft. These arrangements feed structured product data—descriptions, pricing, images, availability—directly into the AI’s knowledge base. When users ask relevant questions, the AI draws from this curated information to make recommendations. This approach offers the strongest visibility but requires technical integration and often formal partnership agreements.

Sponsored product placement functions similarly to search engine marketing, according to retail analysts. Brands pay for preferential visibility in chat recommendations, ensuring their products appear prominently when users ask about specific categories. This model is emerging as AI platforms develop advertising infrastructure comparable to Google Ads or Amazon Sponsored Products.

Custom AI shopping assistants represent a third strategy. Retailers deploy branded chatbots on their own websites or within messaging platforms, creating conversational experiences they control entirely. A furniture retailer might build an assistant that helps customers choose sofas based on room dimensions and style preferences, then completes the purchase within the chat. This requires more development investment but offers complete control over the customer experience.

Getting Started With AI Chat Commerce

Your first step involves auditing your product data infrastructure. AI systems rely on comprehensive, accurate product descriptions, high-quality images, precise pricing, and real-time inventory status to generate useful recommendations. Gaps or inconsistencies in your catalog undermine your ability to participate in conversational commerce, regardless of which integration approach you pursue.

Next, research which AI platforms your target customers actually use. B2C retailers might prioritize ChatGPT and Google’s Gemini, while B2B companies may focus on Microsoft Copilot if their customers work primarily in Office environments. Check each platform’s partnership or integration programs to understand eligibility requirements and technical specifications.

Choose your strategy based on resources and goals:

- Direct integration offers maximum visibility but requires technical capabilities and often substantial investment.

- Sponsored placement provides faster market entry with lower technical barriers.

- Custom assistants give you control but demand ongoing development and maintenance.

Many mid-sized retailers start with sponsored placement to test performance before committing to deeper integration.

64% of customer experience leaders plan to increase investments in conversational AI chatbots in 2026, signaling widespread recognition of this channel’s importance. Track metrics specific to AI-driven traffic, such as:

- Referral sources from chat platforms

- Conversion rates on AI-recommended products

- Customer acquisition costs compared to traditional channels

These data points inform optimization decisions as you scale your conversational commerce program.

The Future Is Omnichannel Plus AI

AI chat platforms will become primary sales drivers alongside traditional e-commerce and physical retail. The competitive advantage flows to retailers who establish their presence early, building brand recognition within these conversational environments before they become saturated. 59% of consumers expect generative AI to transform company interactions, creating pressure on retailers to meet these evolving expectations.

Waiting carries measurable risk. As AI platforms refine their recommendation algorithms using transaction data and user feedback, they increasingly favor brands with established track records in conversational commerce. Entering late means competing against incumbents who already benefit from algorithmic preference and customer familiarity. Your customers are already shopping in these chats—the question is whether your products will be there with them.