If you opened your payroll reports this month and felt your stomach drop, you’re not alone. January 1st brought minimum wage increases across 19 states and 49 cities and counties—a total of 68 jurisdictions nationwide.

For small and medium-sized businesses already operating on tight margins, this overnight shift represents an immediate financial challenge. More than 8.3 million workers will see wage increases, and if you employ hourly staff, your labor costs just climbed without warning.

The question now isn’t whether this affects your business, but how you’ll respond to protect your profitability while keeping your team intact.

Which States Raised Their Minimum Wages?

The geographic footprint of these increases is concentrated but significant. Seventeen states plus Washington, D.C. now enforce minimum wages at or above $15 per hour, up from just eleven states in 2025.

Some standout examples include:

- California: $16.90 per hour

- Washington: $17.13 per hour

- Hawaii: $16.00 per hour

Hawaii delivered one of the sharpest single-year increases: a $2 jump from $14 to $16 per hour. Missouri and Nebraska weren’t far behind, with increases of $1.25 and $1.50 respectively.

West Coast and Northeastern states dominate the new $15+ minimum wage landscape—regions where small retailers, restaurants, and hospitality businesses are densely clustered.

Thirteen states and 44 localities tied their 2026 increases to cost-of-living adjustments, meaning these aren’t one-time legislative changes. Labor costs will continue rising automatically with inflation, creating ongoing pressure rather than a single adjustment you can plan around.

The Impact on Small and Medium-Sized Businesses

The financial burden hits hardest in labor-intensive industries. A small restaurant owner in Seattle recently told me she now faces Washington’s $17.13 state minimum before calculating payroll taxes, workers’ compensation, and benefits. Her true hourly labor cost per employee exceeds $22 per hour—a figure that forces difficult choices about menu pricing and staffing levels.

Employer spending on wages and benefits rose just 3.5% year-over-year as of September 2025, the slowest growth since 2021 and only slightly above inflation. That narrow margin leaves little room to absorb mandated wage increases.

For businesses where labor represents 30% to 50% of operating costs—common in retail, food service, and hospitality—even a dollar-per-hour increase across a dozen employees adds thousands of dollars monthly to overhead.

The timing compounds the challenge. January sits in the heart of business planning season, when you’re finalizing budgets and projections. Sudden payroll increases force immediate recalculation of:

- Profit margins

- Cash flow forecasts

- Pricing strategies

Many SMBs discover their carefully constructed financial plans became obsolete overnight.

Additionally, base wage increases trigger cascading costs:

- Payroll taxes

- Unemployment insurance

- Workers’ compensation premiums

- Health benefits and retirement matching (when tied to compensation)

A $2 hourly raise might actually cost you $2.60 or more per hour when you account for these secondary expenses.

Save hours each month and simplify payroll

Cut HR & Payroll Admin by 60% with This Free Playbook

Simplify payroll. Save time. Free download.

Strategic Responses for Small Businesses

Fortunately, payroll software and workforce management systems can help you navigate this pressure without sacrificing accuracy or compliance.

The manual process of tracking varying wage rates across employees, calculating tax withholdings, and ensuring state compliance becomes unmanageable as costs fluctuate. Modern payroll software:

- Automates wage and tax calculations

- Adjusts for jurisdiction-specific rates

- Flags compliance issues before they become penalties

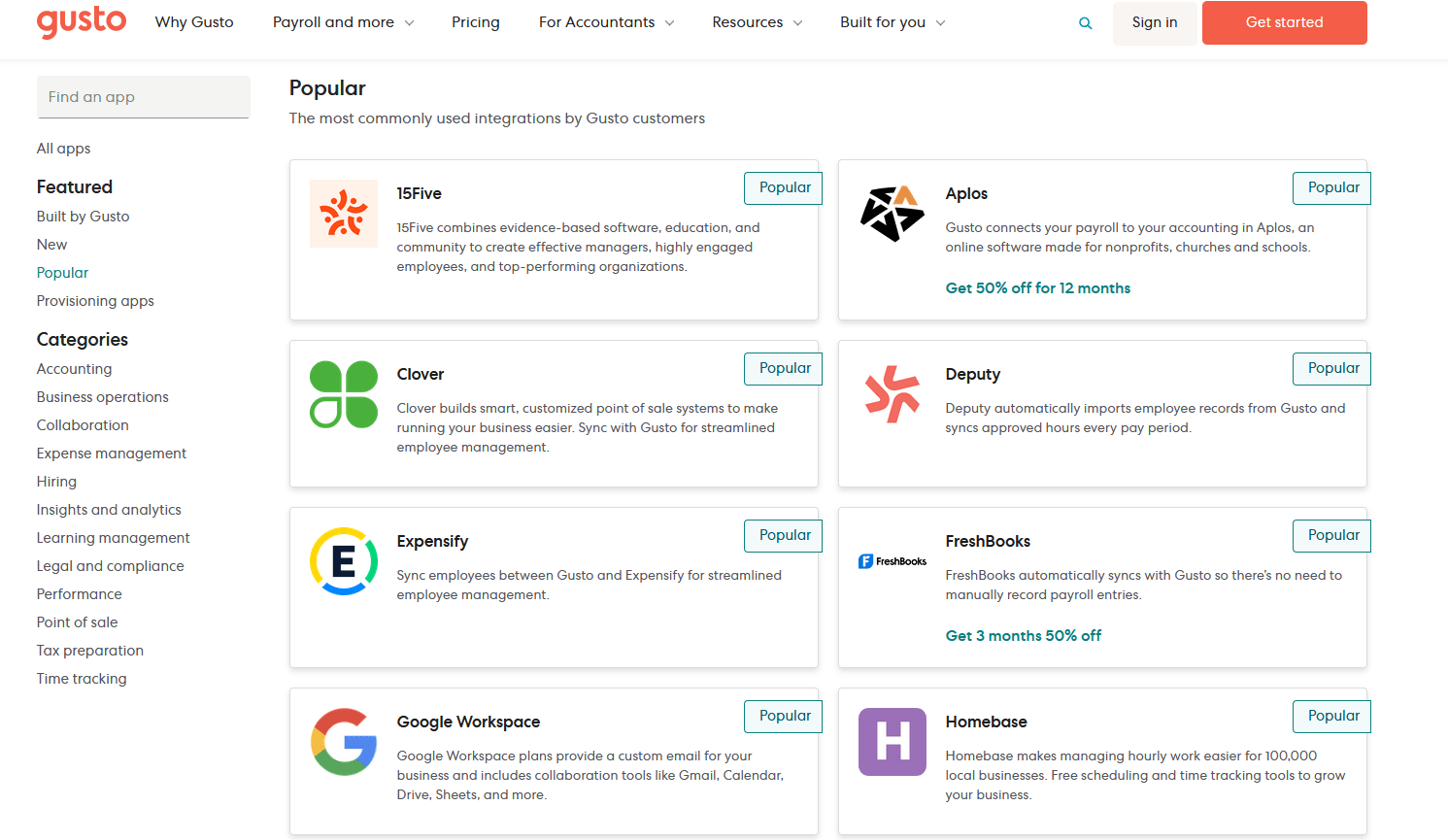

Payroll Automation for Smaller Teams: Gusto

Platforms like Gusto work well for small businesses with 5–50 employees who need straightforward payroll automation.

Businesses choose Gusto because it:

- Automatically updates minimum wage rates by jurisdiction

- Calculates payroll taxes across multiple states

- Integrates time tracking to prevent overpayment

- Handles benefits administration in one system

- Generates reports showing true labor costs, including taxes and benefits

It operates by pulling employee hours from integrated time-tracking tools, applying the correct wage rates and tax rules for each location, and processing payments while maintaining compliance records.

Gusto

Best suited for small to medium-sized businesses, startups, and growing companies seeking streamlined payroll, HR, and benefits management, especially those with limited in-house HR resources or distributed teams

Rasons to buy

- + Intuitive, modern platform with easy onboarding

- + Integrated benefits administration

- + Built-in time tracking and compliance tools

Possible Drawbacks

- –Some users find the interface confusing

- –Subpar FSA platform

- ● Simple plan at $49/month + $6 per employee

- ● Plus plan at $80/month + $12 per employee

Scaling Up and Multi-State Complexity: ADP Workforce Now

For businesses with 50–500 employees or those operating across multiple states, ADP Workforce Now provides more robust compliance tracking.

Companies select ADP because it:

- Manages complex multi-state payroll with varying minimum wages

- Forecasts labor cost impacts before implementing changes

- Monitors compliance automatically across jurisdictions

- Centralizes HR and payroll data for better visibility

- Scales as workforce size and geographic footprint expand

The system works by maintaining updated wage and tax tables for every jurisdiction, alerting you to upcoming changes, and recalculating budgets based on new rates.

Improving Scheduling and Workforce Management

Beyond payroll automation, workforce management software addresses scheduling inefficiencies that waste labor dollars.

Instead of manually building schedules that may overstaff slow periods or understaff busy ones, these systems:

- Analyze historical sales data and foot traffic patterns to optimize coverage

- Reduce the time managers spend creating schedules

- Limit overtime by flagging employees approaching threshold hours

- Improve retention by accommodating employee schedule preferences where possible

Cross-Training for Flexibility

Cross-training employees increases operational flexibility. When staff can perform multiple roles, you can adjust assignments based on demand without calling in additional workers.

This doesn’t require new software—just:

- Systematic documentation of skills

- Intentional employee development plans

- Clear communication about role expectations

For insights into managing distributed teams more efficiently, check out our guide on how to pay international employees and navigate global payroll.

Adapting to the New Baseline

The overnight jump in labor costs isn’t temporary. With cost-of-living adjustments now built into many state laws, expect continued upward pressure in future years.

Businesses that treat this as a one-time shock rather than an ongoing trend will find themselves repeatedly caught off-guard.

Review your payroll strategy now—not next quarter.

Key actions include:

- Analyzing which positions are most affected

- Calculating your true hourly costs, including taxes and benefits

- Evaluating whether your current pricing structure supports these expenses

- Identifying areas where operational efficiency can recover margin

Payroll and workforce management software won’t eliminate the increased costs, but they’ll help you understand exactly where your money goes and where operational efficiency can make a difference.

The businesses that navigate this transition successfully will be those that combine strategic planning with operational tools designed to reduce waste and improve accuracy.

You can’t control minimum wage laws, but you can control how efficiently you deploy every labor hour you pay for.